Travel demand remains robust

Global demand, despite economic and geopolitical uncertainties, remains strong in 2025, as people continue to ring-fence their budgets and invest money in travel.

APAC makes a full recovery

According to IATA, APAC saw record flight demand in 2024, as total full-year traffic rose 10.4% from 2023 – that’s 3.8% above pre-pandemic levels. Capacity was also up by 8.7% on 2023.*

In fact, APAC made a full recovery last year, with growth projected to rise further through 2025. What’s more, APAC airlines posted a 26% rise in full-year international traffic, with capacity rising 24.7% – making it the world’s fastest growing region YoY.*

India, in particular, is experiencing high growth. The WTTC notes that the country’s travel sector accounted for $221 billion of the country’s GDP in 2023, jumping 10% since 2019. India’s travel contribution will grow close to $500 billion by 2034.**

International airline traffic rose 10.4% in 2024, 3.8% above 2019 levels

Booking trends – Patterns stabilised in 2024

Booking windows worldwide stabilised last year as traditional patterns of seasonality continued to resume alongside growing traveller confidence.

Booking windows stabilise

For the first time, global booking windows have stabilised year-on-year in a sign that traveller confidence continues to grow.

Over half of travellers (53%) are booking their trips over a month in advance, with the largest segment (31%) booking between 31 and 90 days in advance. Nearly half of travellers continued to book their flights less than a month ahead, with almost 1 in 5 booking less than seven days before departure.

Looking at the Middle East and North Africa region, which tends to have shorter booking windows, there’s been a little more change across the board – but the patterns remain broadly in line with last year.

Compared to global windows, fewer travellers in MENA are booking flights more than a month out: 59% book less than 30 days before – preferring to wait until nearer the departure date, with a quarter (24%) booking within just seven days.

Easter travel outlook is strong

The shift in Easter’s dates from the end of March 2024 to the middle of April 2025 is reflected in both airline volume and yield, as travellers make the most of the holidays to get away.

Bookings have grown YoY for both March and April, with growth in domestic travel for April double that of March (+60% vs +29%). International travel is growing too, increasing +17% YoY for March and +62% YoY for April.

European outbound traffic shows strong growth to all destination regions, especially the Middle East and North Africa (135%), Northeast Asia (130%) and the Indian subcontinent (120%), reflective of the higher demand during the Easter period.

There are high rates of percentage growth for inbound Northeast Asian traffic from most regions, particularly the Indian subcontinent (140%), Europe (130%) and Australia and New Zealand (124%).

Skyscanner is visited by 110m+ users worldwide every month

Planning trends: Experience-driven, tech-inspired

Travellers want experiences they can share alongside others with similar interests, to enjoy being part of something bigger than themselves. We explore these trends, including generational differences, as traveller behaviour continues to evolve.

We surveyed 19,000 travellers in 16 markets aged 18 to 65+ to discover the type of trips they’re taking and how they’re planning them.

Travellers are searching for collective, shared experiences, choosing destinations which align to a particular type of attraction, occasion or event. And now more than ever, people want experiences they can enjoy alongside others, to be part of something bigger than themselves.

Conscious-led travel is also a theme we’re seeing, as many travellers look to minimise their impact on the places they visit. Like the other trends, there are some interesting generational differences we explore too.

Seven collective experiences we’ve identified for 2025 are:

- Sport Mode

- Astro Adventurers

- Reset Jetters

- Art-Venture

- Cowboy Core

- Horti-Culture

- Gami-Vacation

You can explore the seven trends in more detail here.

We’re seeing these trends reflected in our search and redirect data, with Sport Mode, below, being a prime example.

Sport Mode kicks off

Sport Mode is one of the biggest trends for 2025. Almost half (49%) of travellers are planning to travel to attend a sports event this year – either abroad, in their home country, or both.

Younger travellers are even keener to experience live sport: 71% of Gen Z (aged 18-24) are ready to travel to see their favourite players or sports stars.

We’ve seen the popularity of Sport Mode in our traveller search data*, with particular spikes in demand for:

- The UEFA Champions League Final in Munich, Germany, 31 May – 110% WoW search increase

- The Formula 1 Qatar Grand Prix 2025, 28-30 November – 111% WoW search increase

Live sport is such an exciting draw that 37% of travellers (and 52% of Gen Z) say they’ve attended a sporting event without actually knowing much about it, looking instead to enjoy its unique atmosphere.

* Based on Skyscanner search data from 23 January 2025.

Conscious-led travel is top-of-mind

Conscious-led travel – the pursuit of travelling while reducing negative impacts on the environment, societies and economies – is important for travellers, especially Gen Z.

Overall, 26% of people are willing to reduce their impact on over-tourism by visiting quieter destinations. This rises to 29% of 18-24-year-olds compared to 22% of those aged over 65.

However, travellers visiting less touristy places say they still need some reassurance and information to make informed decisions to get the best out of their trip. The top three concerns are:

- Safety (50%)

- Understanding where to go (32%)

- Having confidence there’s enough to do (30%)

40% aged 18-24 say they’d struggle knowing where to go, compared to just 28% of over 45s. While 38% of 18-24-year-olds don’t believe there’d be enough to do. At 25%, this is less of a concern for those aged 45+.

Over a quarter (26%) of travellers say they’d consider destinations where they feel they can make a positive impact. This increases to 34% for younger travellers aged 18-24, but drops to 13% for people aged 65+.

Travellers are confident using AI

Travel can often be stressful and complicated. That’s why nearly half (47%) of travellers say they feel confident using AI to help them plan and book.

Younger generations have been quicker to adopt AI and feel more confident putting it to use: 92% aged 25-34 feel confident vs 23% of over 65s.

Travellers are using AI to:

- Research destinations (35%),

- Compare flight or hotel prices and options (32%)

- Create a travel itinerary (30%)

When it comes to destination research, 42% aged 25-34 are using AI to discover where and when to go, compared to 22% of over 65s.

EMEA top and trending destinations

Discover the most popular and fastest trending search destinations for travellers from EMEA.

Europeans will explore their own backyards, plus hidden gems

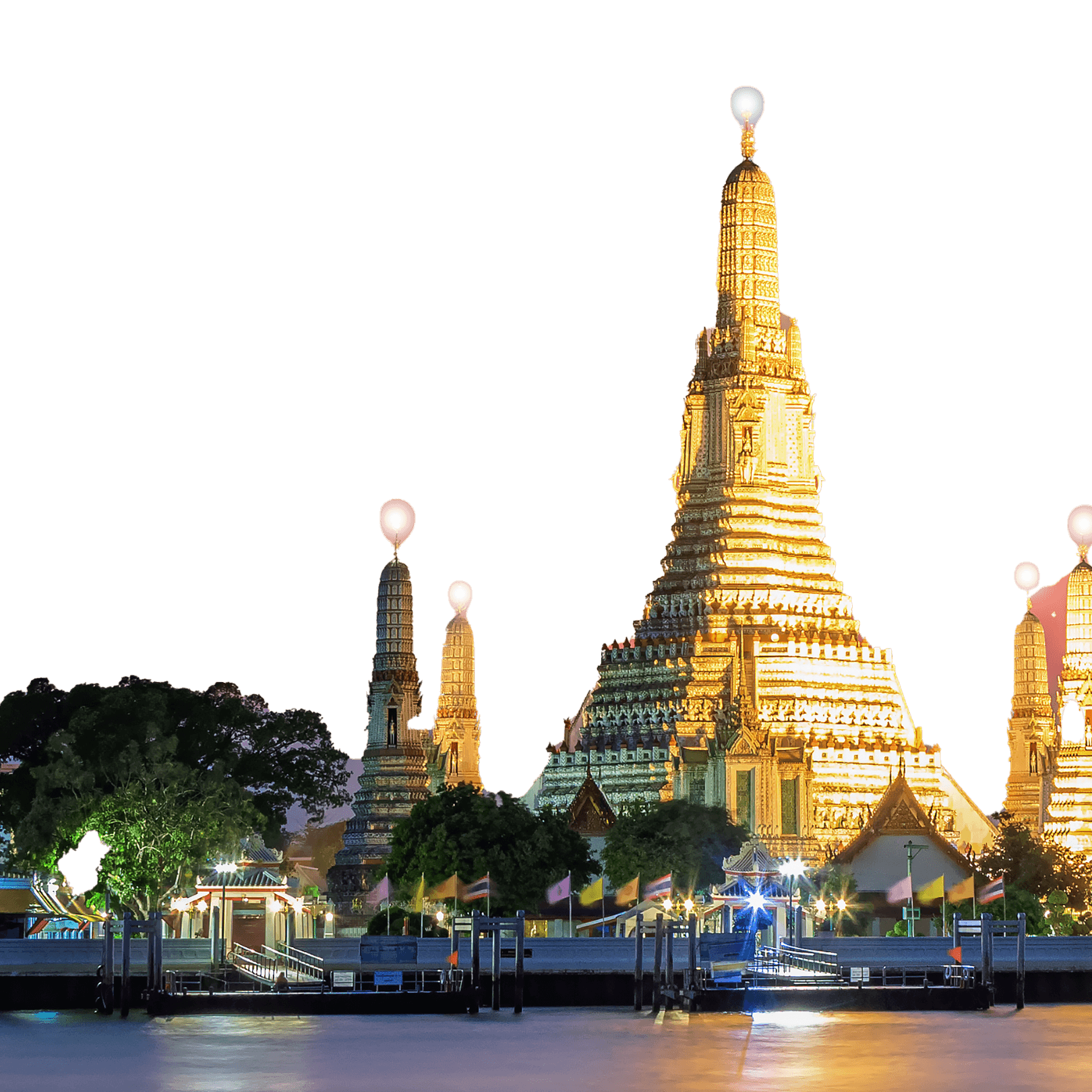

The most popular destinations for travellers are largely across Europe itself. Eight of the top 10 are in Europe, with only Bangkok outside at number nine. Search volumes for Barcelona, Palma and Madrid confirm Spain’s continued popularity, while Italy features two cities in Rome and Milan.

But where are the fastest trending destinations over the past 12 months?

A mix of short- and long-haul destinations show that EMEA travellers are seeking a mix of beach, nature and culture experiences.

Morocco’s Beni Mellal has claimed the number one spot after a massive 2,422% increase in searches, becoming a rapidly growing tourist destination that's already benefitting from a recently reopened international airport.

Discover more about the top 10 trending destinations in our last Horizons report: 2024-25 Spending, Planning and Destination and Insights.